Hiiii from Paris. What a crazy month June has been, and it’s only the 4th. We quickly went from “And then, one fairy night, May became June.” (F. Scott Fitzgerald) to watching the city being set on fire.

Meanwhile, if you want to hear a more personal take on money and investment styles,

featured me on her nuanced and oh so smart Substack :xoxo Esther 💋

Rather than conducting an in-depth analysis of specific trends, here are my takes on brands you may have seen in the news recently. Quick insights on whether there is any longevity to them. Are they part of growing trends, or will they fade away soon?

Food:

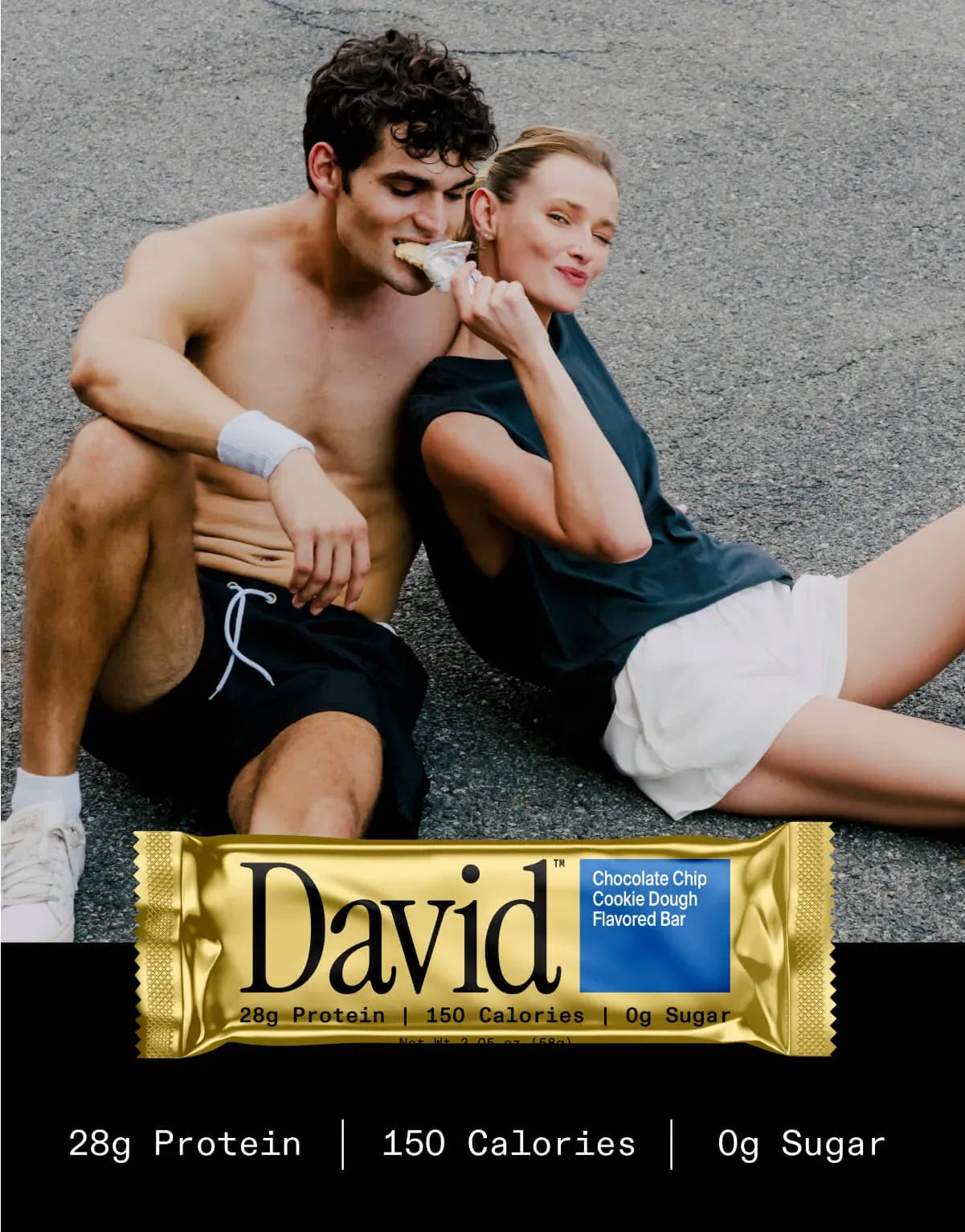

Protein → Keep.

David, the brand behind the infamous protein bar, has closed a $75M Series A, led by GreenOaks and Valor Equity Partners as well as acquired their ingredient supplier, Epogee1. You also can’t have missed the launch of Khloud, Khloé Kardashian’s Protein Popcorn. Bon appétit!

Branded Wellness → Keep.

The trend started by über-luxe LA grocer Erewhon of collaborating with celebs (Bella Hadid, Hailey Bieber) for overpriced ‘beauty’ smoothies — aka glorified milkshakes — lives on at other health eateries with a Marc Jacobs x Happier Grocery. I could see a Rosie Huntington-Whiteley x Harrods smoothie happening in London.

Liquor → Sell.

We’ve been seing a shift towards no-low (nonalcoholic or low-proof drinks) and this NYT story on Gen Z not opening tabs at the bar is the last nail in the coffin: “Gen Z is drinking less than older generations. A 2023 Gallup poll found that the number of adults ages 18 to 34 who said they had “occasion to use alcoholic beverages” had fallen 10 percentage points over the last 20 years.“ Unless someone comes up with a protein-packed liquor…

Beauty:

Celebeauty → Sell.

The bubble has to burst at some point. We’ve all seen the headlines re: Rhode Beauty, Hailey Bieber’s brand, selling in a $1B acquisition by lower-priced E.l.f., mostly known for producing dupes. $212M net revenue for a DTC brand that launched in 2022 and currently has 10 SKUs is actually so impressive. A big w for boring basic bitches everywhere.

This is coming after continued success for celebrity-backed brands: Fenty/Rihanna, Rare/Selena Gomez, Haus Labs/Lady Gaga. But the market is saturated and this may be one of the last big exits we’ll see in the near future.

I highly commend Miley Cyrus for saying ‘I don't have a makeup line because I'm not a makeup artist.’

DIY maintenance → Buy.

Salon procedures’ prices keep rising2: hair colour, hair removal, mani/pedis. We’ve seen the emergence of ‘recession blonde,’ essentially shifting towards hair colours and cuts designed to space out salon appointments. Other sectors of beauty will follow suit, with consumers investing in at-home tech (electrostimulation, laser hair removal, nail lamps) and products to mimic a salon experience.

Media:

Built-in Audiences → Buy.

‘The Tennis Podcast’ Joins The Athletic Podcast Network (property of the New York Times). It’s much easier to buy a media brand with a proven audience: “Since its launch, the show has garnered over 30M downloads, becoming the most-listened-to podcast in the sport” rather than building from scratch.

Grindcore → Keep.

Remember the 2016 #girlboss? Evil doesn’t die, it just reinvents itself. As

of Feed Me puts it: “It used to be company first, media persona second. Now, influencers are investing in skirt suits and backdrop lighting for career podcasts before they've even figured out their CAC. The aesthetic of work — and the performance of ambition — can be more polished than the business behind it. It also becomes the attachment point for ads and subscriptions, and before long, the “building in public” content IS the business.” Case in point, 3 podcasts: The Burnouts by Phoebe Gates (Bill Gates’ daughter); Confessions of a Female Founder by Meghan Markle; ASPIRE with Emma Grede, co-founder of SKIMS and Good American.Meanwhile, WSJ reports on Celebrities’ Toughest Get: An Invitation to Harvard Business School. Essentially, no one wants to be ‘just’ another influencer; one must be a businesswoman, endorsed by Harvard at that.

Tech:

Health Tracking. → Buy.

Oura rings and their copycats are doing well, and so are Whoop bands. Everyone around me in Paris is building brands around longevity and preventative health3. The depth of the market is immense, and adoption isn’t slowing down anytime soon. Essentially, 1. we all feel like shit; 2. we want to know why; 3. we want someone to tell us how to live better.

Legacy Tech. → Keep.

Did you know BlackBerry was still around? If you read last week’s letter about nostalgia, you’d make an educated guess that consumers want to go back to the beloved keyboard. However, the company’s big asset is possibly already featured in your car: QNX, BlackBerry’s automotive software division, dominates the software-defined vehicle (SDV) market, embedded in 90% of SDVs—over 255 million vehicles. QNX pivoted from infotainment to full-car operating platforms, making it the company's growth engine. QNX posted $236M in revenue in FY2025, up from $130M in 2021, with expansion into medical, industrial, and rail sectors underway.

📈 Bullish news

White Wine Is The New Black [Bustle]. Sales for U.S. reds declined more than 5% in 2024. White wine, less than 2%. After years of experimentation with funky oranges, our tastes are going back to the basics. Is this… dare I say… a recession indicator? I kid, I kid.

Sequoia bets on indie films with $100M Mubi fundraising [FT]. Mubi is now valued at $1B.

Alo Builds on Its Stackable Wellness System With Daily Greens Shot Launch [WWD]. tl;dr Alo Yoga, originally an activewear brand known for capitalising on celebrities taking selfies in their branded gyms in LA and NY, is trying to take market shares from AG1 with a super greens powder.

Court says Trump doesn't have the authority to set tariffs [Axios]. The court, ruling in two separate cases, issued a summary judgment throwing out all the tariffs Trump imposed under the International Emergency Economic Powers Act, or IEEPA.

The number of women running Fortune 500 companies hit a new high this year [Axios]. There are 55 women CEOs leading the nation's biggest firms by revenue. This is the first time the share of women leading these giant firms has crossed the 10% barrier.

Trump media group plans to raise $3B to spend on crypto [FT]

Womenswear brand Staud was looking for investors earlier this year. They just closed a $28M fundraise.

📉 Bearish news

The New Dream Job for Young Men: Stay-at-Home Son [WSJ]. *insert Steve Carrell NO NO NOOOO .gif*

AI could wipe out half of all entry-level white-collar jobs — and spike unemployment to 10-20% in the next one to five years [Axios]. According to the CEO of Anthropic, so not totally unbiased.

As Gen Z blows rent on Taylor Swift tickets, they say they feel ‘judged’ and blame schools for not teaching them how to budget [yahoo!finance] 39% of the 19-28 year olds surveyed who said they felt judged say their biggest critics are their family. 17% feel like they’re being side-eyed by social media. 22% turn to “finfluencers” to get their financial advice instead.

Pinterest wooed Gen Zers. Will AI pins drive them away? [FastCompany] Gen Z, which makes up 42% of Pinterest’s user base, is increasingly frustrated by the flood of AI-generated content overtaking the platform. “AI slop farmers” are reportedly earning up to $10K a month by flooding Pinterest with AI content.

If you’re looking for me, here’s my Instagram and my Sicilian house’s Insta. Here’s my LinkedIn. Choose wisely, or don’t.

What is EPG you ask? Let’s rewind back to 2011, EPG or the artist otherwise known as esterified propoxylated glycerol is made and patented by Epogee, a new kind of fat that would reduce calories from fat by 92%, by allowing fat to pass through the body without being fully absorbed and reducing caloric intake. [Snaxshot]

rightfully so! Hairdressers, waxers and nail techs also face rising costs.

I’m currently testing one, will report back.