#50 Founder Saturation

Wait... If I'm a founder and you're a founder then who's flying the plane?

Hiiii. If you’re wondering where I was lately, this is an accurate representation of the past few weeks:

I’m getting treatment, *cue collective sigh of relief.* This week, we’re dissecting the state of founders and what industries are heating up going into 2026. A note: because of what I do, I get asked quite often why I don’t start my own company. For now, I’m happy translating cultural signals into investment theses, but I’ll let you know when that changes. xoxo Esther 💋

I’m bearish on

💄 Founding a beauty line.

If founder is now a cultural archetype, it didn’t happen all at once. The past 25 years have produced eras where one industry became the most prestigious, hottest place to build a brand, attach your identity, and perform entrepreneurship. The girlboss is dead, long live the girlboss!

THE CANON: 2000s to now

1. 2000s: Tech as the Original Founder Fantasy, brilliance > aesthetics

The decade belonged to hoodie-wearing prodigies. The founder was a hacker-genius archetype, defined by garages, code, and the worship of disruption. Think Jobs, Zuckerberg, Page & Brin.

Why it mattered: introduced the founder as celebrity. Cue movie adaptations.

2. Early 2010s: Beauty as the Aesthetic Empire, taste > expertise (until expertise becomes necessary)

Enter Emily Weiss, the patron saint of millennial founder culture. Glossier didn’t just create products; it created the aesthetic of the founder. Suddenly, being a beauty founder was chic, feminine, and modern. This era sparks the deluge: celebrity brands, influencer lines, clinical-luxury hybrids.

Successes: Rhode, Summer Fridays.

Failures: the graveyard of celebrity beauty, from KKW to countless short-lived collabs.

Further reading:

3. Mid-Late 2010s: Wellness as Lifestyle Entrepreneurship, body as proof of concept

The rise of founder-gurus: founders who doubled as spiritual advisors, instructors, biohackers. From boutique studios and adaptogenic powders to the ritualisation of hydration, wellness became a founder farm.

4. Early 2020s: Food as Intimacy Infrastructure, comfort + personality

Cookbook authors and Substack writers morph into CPG founders. Alison Roman becomes the template: domestically-rooted authority into brand builder.

Less threatening and more attainable than a Martha Stewart.

Food wins because it’s emotional, habitual, and immensely shareable on social media. It’s a category where creators already feel embedded in people’s homes.

5. Mid 2020s: Home & soft living, taste as domestic power

Interiors creators leverage aesthetics into homewares: paint lines, linens, cookware, and fragrances. Homes became moodboards during the pandemic, and creators cashed in.

THE FORECAST: 2026 AND BEYOND

Here are the 3 industries I would invest in. They’re the ones showing early signs of becoming the next it-founder arenas.

1. Pet wellness

A giant emotional market with terrible design. Creators already treat their dogs like lifestyle extensions. The leap to founder-led pet wellness, grooming, or supplements is inevitable. Think: Glossier for pups.

2. Micro-Hospitality

Renovation influencers turn into Airbnb hosts turn into founders of scented, textural, ritualised “mini hotels.” The next frontier is hospitality-as-product: bedding kits, uniforms, signature scents, architectural touches in a box. Think: Soho House, but human-sized (don’t fight me on this: the company lost all its aura once it started scaling).

3. Everyday Pharma

The post-supplement category for chronic-but-boring problems: migraines, colds, PMS, skin barriers, gut flare-ups, and menopause symptoms. Founders will position themselves not as gurus but as pragmatists who fixed what pharma ignored. Bonus points for adopting an East meets West philosophy. Think: Muji x Tylenol.

Every decade produces new founder archetypes, but the underlying formula doesn’t change. Intimacy > identity > product > myth. Beauty may have defined the 2010s, but the next wave won’t look like Glossier. It’ll look like dog shampoo, tiny hotels, and soft-minimalist OTC drugs. Are you the next Emily Weiss?

If you’ve made it this far, consider adding a like, a comment or sharing the post.

📈 Bullish news

AI stocks could be part of a new Magnificent 7 (Axios)

The manosphere is going into business (FT). Online influencers are targeting young men with tips on how to walk, talk and breathe.

Because being at the helm of the most valuable companies in the world isn’t enough: Elon Musk runs an AI startup — now, so does Jeff Bezos, as he launches Project Prometheus (Sherwood).

Have you started vibe coding? This is the first backing of this type I’ve seen: VC Pitchdrive leads Stardust’s €1.7M pre-seed round, alongside Anton Osika (Lovable). The startup was built entirely on Lovable (=vibe coding).

AI not real enough for you? French startup Beside funding nets $32M to build an AI for the real economy (Startup Hub).

In better-for-you snacking news: UK beverage co TRIP Surpasses $300 M In Valuation, Closes $40 M Funding Round (Forbes). The f&b sector is heating up: Oyster Bay (La Vie, Oatly) raises over €100 M to scale Europe’s best food innovators. The fund was reportedly significantly oversubscribed, with only 0.1% making the cut (EU-startups).

Got a health wearable such as an Apple Watch or Oura ring? Welltory takes your wearable data and analyzes it against 100+ biomarkers to instantly identify when your stress levels are starting to pile up (Product Hunt).

What does being a serial beauty founder entail? Julie Schott’s Crystal Ball (Bustle). I had highlighted her work exactly 1 year ago—this means you should probably pay attention to whom I pay attention to :)

📉 Bearish news

Luxury Brands’ Stiffest Competition Is the Stuff They Have Already Sold (WSJ). Sales of secondhand luxury goods are growing faster than in brands’ own stores.

Independent newspapers disappear as private investment firms take over (Axios).

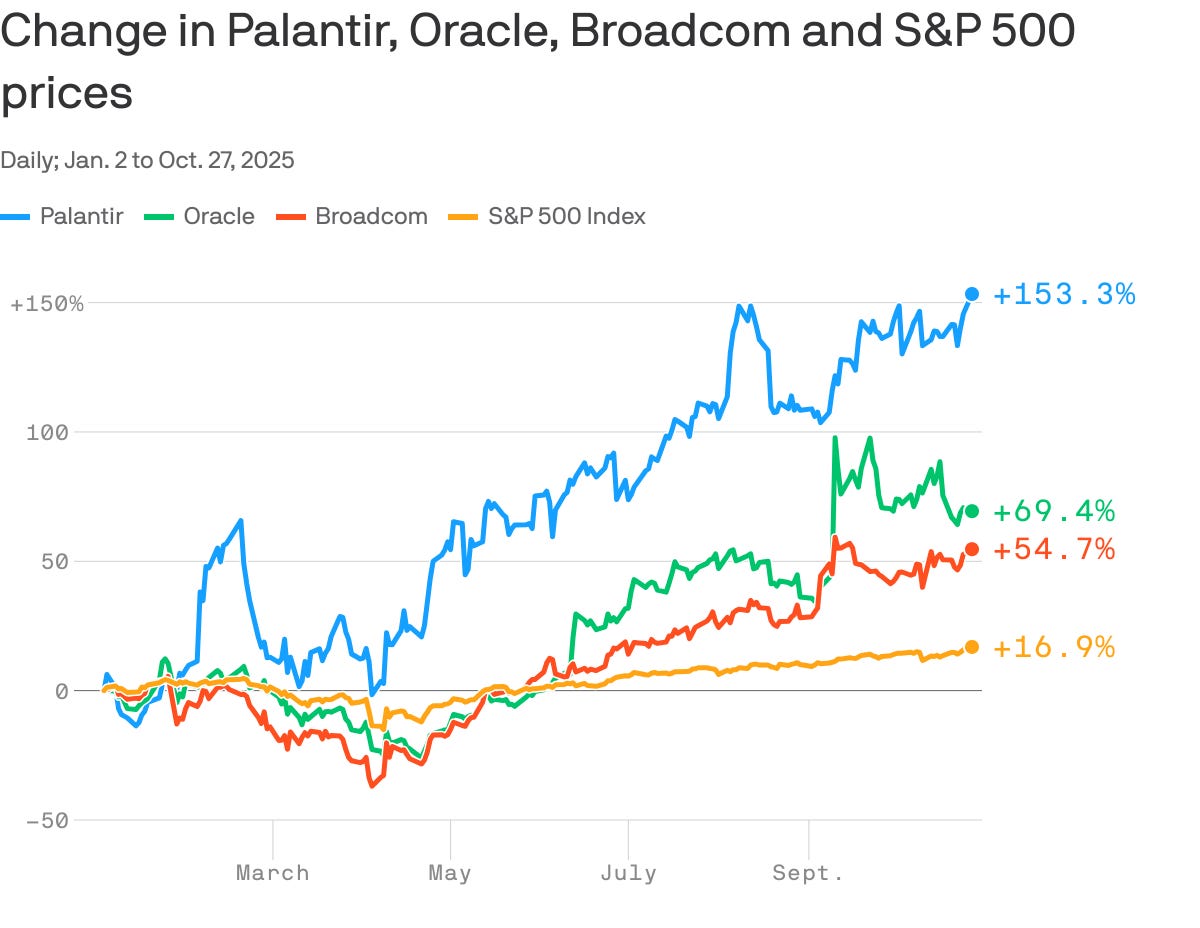

Investors blind to stocks outside AI: Wall Street’s AI obsession is blinding investors to investment opportunities that exist outside of the technology. The AI trade has dominated the market and its gains. If that boom plateaus, certain non-AI stocks could lead the next leg of the rally. Bank of America recommends picking stocks versus owning the entire S&P 500, which is too heavily weighted toward AI (Axios).

Layoffs may be rising, but people are also getting rehired more often as part of a “layoff boomerang” trend. AI may not be the headcount reducer that it’s cracked up to be, at least not yet. About 5.3% of laid-off employees end up being rehired by their former employer (Axios).

Gen Z dreams of a ‘Ralph Lauren Christmas’ in a dollar store American economy (Fortune). This is reminiscent of the class cosplay concept I —clumsily— introduced in #2 of Oblique Forecasting: “I find it very dark that the current generation must feast on dupes instead of ever tasting the real thing (wealth).”

![#11 [USER] is people too](https://substackcdn.com/image/fetch/$s_!agPB!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1b4d3119-1502-45d1-8314-052755ee4a9d_1995x1125.jpeg)

Welcome back 🙌